Monarch Money - A Modern Way to Budget your Money

Keeping track of numerous financial accounts, investment accounts, and bills can make it simple for things to get lost in the chaos. All of your financial data can be easily stored on your mobile with a personal budgeting app like Monarch Money, providing you with a window into your present and future financial situation.

What is Monarch Money?

With the help of the money management app Monarch Money, you can track your investments and net worth, make a budget, establish savings targets, and much more. The fact that it can combine all of your financial accounts—not just your checking and savings—sets it apart from many other budgeting tools. The above picture is the Monarch Logo.

Monarch, also referred to as Monarchmoney, debuted its app in 2021, making it a relative newbie to the personal budgeting space. With over 100,000 downloads on Google Play alone, Monarch Finance has expanded rapidly despite just being around for a few years.

The company was formed by startup experts with backgrounds in engineering and design, with the goal of empowering people to develop healthy personal finance habits through the use of easy digital tools.

💡 Perfect for couples and joint budgeters, Monarch app allows you to discuss goals without compromising privacy by offering separate logins under a single account.

It is made for both average people looking to do better at tracking their spending and budgeting and for personal advisors looking for a client-focused method of giving their clients simple-to-use Monarch budget app.

Why Monarch Money Is Popular?

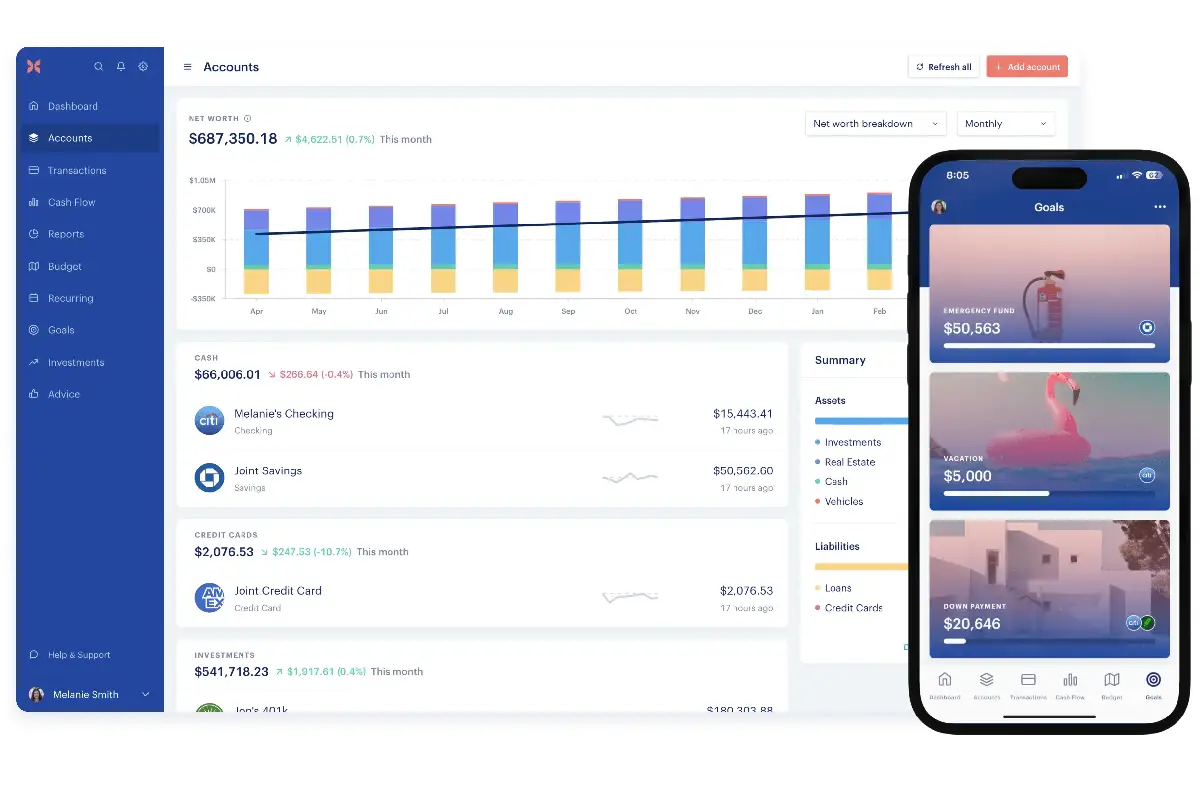

Compared to other budgeting applications, Monarch offers greater collaboration. You may use the app's tools, reports, investment tracking, and other features to work on your monarch budget with a spouse or another trusted person, or you can work with your financial advisor. It's simple to sync all of your financial accounts to a single Monarch account, which allows you to view your information from several devices at any time.

💡 Monarch Money makes it simple for users to synchronize several bank accounts, centralizing their financial data from different institutions.

We particularly appreciate Monarch Money's commitment to investing as opposed to only monitoring your earnings and outlays at the moment. The application evaluates your investment portfolio and displays the relative strengths and weaknesses of individual investments. By using Monarch, you can increase your financial fortune and learn how to spend less money.

Features of Monarch Money

It's amazing how many features Monarch Money offers. However, given its price range, it ought to include a ton of features. The key characteristics of Monarch Money are as follows:

- Tools for Flexible Budgeting

- Budgetary Objectives and Net Worth Monitoring

- List of Calendar Transactions

- Tracking Investments

- AI Helper

- Integrated Collaboration Features

- Personalized Spending Reports

- Recurring invoices

- List of Calendar Transactions

Most notable characteristics within these categories

1. Adaptable Regulations for Groups: This implies that you can classify your purchases automatically according to the titles of the transactions, the sellers, or even the total amount spent.

2. Finicity, Plaid, and MX account syncing: The over-reliance on Plaid connections in budgeting apps is currently one of their main problems. Monarch gets around this problem by using two additional data aggregators.

3. Group-based Financial Planning: Organizing your spending into groups of related categories helps you make your budgets simpler. As a result, it becomes simpler to plan ahead and modify your spending as needed.

Cash Flow Illustration: Understanding where your money is going might help you make important decisions about how much you spend. Being aware of your current financial situation enables you to make the necessary changes to reach your objectives.

Who owns Monarch Money?

Val Agostino

Val Agostino is the Co-founder and CEO at the Monarch Money

Contact Info

- Val’s Profile: linkedin.com/in/valagostino

Jon Sutherland

Jon Sutherland is the Co-founder and Head of Design at Monarch Money

Contact Info

- Jon’s Profile: linkedin.com/in/jmsutherland

- Website: dribbble.com/jmsuth (Dribbble)

Ozzie Osman

Ozzie Osman is the Co-founder and Head of Engineer at Monarch Money

Contact Info

Osman (Ozzie)’s Profile: linkedin.com/in/oaosma

How Much is Monarch Money?

Before committing to a subscription, you can test out all of Monarch Money review all premium features for free for a whole week. However, you'll need to upgrade to a subscription that costs $14.99 a month or $99.99 for a full year in order to get the most out of Monarch Money.

Everything you most likely downloaded Monarch for, like tying in your bank accounts, monitoring your assets, making custom transaction categories, examining personalized financial reports, and more, is available to you with the premium plan. To help you stay on top of things, you'll also receive alerts for your subscriptions and regular bills.

Sometimes Monarch runs promotions for extended 30-day free trials, allowing potential users to get even more use out of the app before committing to a purchase.

| Packages | Cost | Features |

|---|---|---|

| 1. Annually | $99.99 | Features include all investment tracking, financial reports, bank links, and custom categories |

| 2. Monthly | $14.99 | Same as the Annual Package |

| 3. Free Trial Period | 7 Days | Access to all Premium Features |

How to Use Monarch Money?

Although there may be some heavy lifting involved in getting started with Monarch Money, the automations and integrations may make the process go more smoothly than you might think. The actions you must do to begin are listed below.

-

Install the application - You may start Monarch Money in your browser or download it from the Google Play Store or Apple App Store.

-

Make a profile - Use your email address or an existing Apple or Google login to register. Then, to begin using the program, adhere to the prompts for the introduction.

-

Add your accounts - Utilizing Monarch's data suppliers, link your bank accounts, credit cards, loans, and other financial accounts. Budgeting and keeping track of your spending will be made easier the more accounts you connect.

-

Make your own category - Three forms of transactions are distinguished by Monarch: transfers, expenses, and income. You can add and modify categories and category groups within these transaction types to suit your needs. For instance, you may remove the "auto" category if you don't own a car.

-

Set objectives - Prioritize your savings by using the Goals tool. After that, you may keep track of transactions into and out of your target accounts by assigning distinct accounts to each of your goals.

-

Make a budget now - Your transactions are automatically categorized by Monarch, but you might need to make some adjustments—especially at beginning. Verify that every transaction—including income—is appropriately classified.

-

Add more personalizations - You can add household members to your account, add transaction "rules," and customize your dashboard once you've set up a basic budget in your Monarch account.

How to Get in Touch With Monarch Support?

Send an email to support@monarchmoney.com to get in touch with the support team if you're experiencing issues with your Monarch Money app or account. simply send the business a direct message on X (previously Twitter).

Consider using Monarch Money's help section, which offers a variety of useful articles that explain how to use each feature, if you have general questions or want to learn more about how it operates. You can use the help center to file a request for assistance if you are unable to locate what you're looking for. The support team will get back to you.

How to Cancel Monarch Money?

Navigate to your account settings on the website and look for the subscriptions section. You ought to see a link to cancel your membership from here.

Alternatively, you can browse to the settings on your app store and cancel Monarch Money directly from the app. To cancel your Monarch Money membership, go to your subscriptions and locate it.

Best Monarch Money Alternatives

YNAB vs Monarch Money

Monarch and You Need A Budget (YNAB) have the ability to automatically classify your transactions and link to your bank accounts, making them both suitable with a zero-based budgeting approach. When it comes to giving you a more complete picture of your finances, Monarch Money offers other tools like investment tracking, whereas YNAB is primarily focused on budgeting.

YNAB stands out for having an amazing collection of tutorials, workshops, videos, and blog posts. Additionally, YNAB has a lengthier 34-day free trial even though it is also a paid service.

Empower vs. Monarch Money

When it comes to investment tracking and net worth tracking, Empower outperforms Monarch Money because you can use these tools for free!

Even though Empower provides free spending tracking, its extensive and adaptable budgeting tools are incomparable to those of Monarch Money.

So, Empower is a fantastic substitute for Monarch Money if all you want to do is keep track of your investments and net worth. Despite lacking any free features, Monarch Money is the obvious victor if you're in it for the budgeting tools.

Credit Karma vs. Monarch Money

It is not a budgeting app, Credit Karma. Rather, it keeps an eye on your credit and provides additional relevant resources. Credit Karma can be accessed via a mobile app or the internet, just as Monarch Money. It also ties up with glance intuit[glance.intuit.com] But the business recommends users make use of particular tools and features that were created especially for the app.

With the Credit Karma app, you may access options for financial relief, receive advice on how to improve your finances, and view your own acceptance odds for a credit card or loan. You can, of course, also keep an eye on your credit. Through the app, you can also access Credit Karma Money Save, a high-yield savings account. Credit Karma is free but has adverts, in contrast to Monarch.

Rocket Money vs. Monarch Money

Both Monarch and Rocket Money have an equal amount of features. When it comes to price, though, Rocket Money comes out on top.

The monthly cost of Rocket Money Premium ranges from $6 to $12. If you select the annual option, this cost drops to $4.00 each month. As a result, Rocket Money's lowest yearly cost is 52% less than Monarch's.

Additionally, there is a free version of Rocket Money that offers the following features:

- Alerts for Subscription Management, Account Linking, and Balance

- Monitoring Expenses

- Monitoring Credit Scores

There is a major warning regarding Rocket Money before you transfer. Its dependency on Plaid for all of its connections is the reason for this.

Therefore, try Rocket Money first and see whether you can link all of your accounts. It's generally best to stay with Monarch if not.

PocketGuard vs. Monarch Money

You can integrate bank accounts, credit cards, loans, and investments with PocketGuard, just like you can with Monarch Money. In addition, it monitors your net worth and notifies you of impending recurrent fees.

A feature that sets PocketGuard apart is its debt payout planning tool, which makes it simple to arrange your obligations and monitor your progress toward repayment.

Monarch provides a longer-term, panoramic perspective of your finances, whereas PocketGuard tends to concentrate more on bill payment and money savings.

There's a free plan with PocketGuard, unlike Monarch Money. However, access to all of the sophisticated capabilities of PocketGuard Plus is restricted to paying users only. Comparable to Monarch Money, PocketGuard Plus has an annual subscription fee of $74.99 and a monthly subscription fee of $12.99.

Cushion vs. Monarch Money

The most effective method for setting up recurring payments is Cushion. With the Cushion App, you can monitor and settle your bills as well as debts that are Buy Now, Pay Later (BNPL). Additionally, by making these regular payments using the Cushion Debit Card, you can also establish credit.

Because Monarch can only view your bills, it is inferior than Cushion when it comes to bill payment. This implies that you cannot pay your bills with Monarch; it can only show them on a calendar, something Cushion also does.

Cushion AI has two plans as of right now:

- Each month, AutoPilot costs $4.95.

- Cushion Pro has a monthly cost of $12.99.

With AutoPilot, users can monitor every one of their recurring payments on a single dashboard and, if desired, synchronize their calendars with AutoPilot's due dates.

Cushion Pro offers all of AutoPilot's functions plus the ability for users to establish credit through bill and BNPL payments.

Neontra vs. Monarch Money

In December 2023, a brand-new personal finance management software (PFM) called Neontra was released. When it comes to prices, Neontra is far less expensive than Monarch Money.

Neontra is available for $7.00 a month or $45.00 a year. It provides an enormous 45-day free trial, after which you'll be reverting to the free plan. Unfortunately, most individuals cannot use Neontra's free plan because it only allows one connection.

Neontra uses the 50/30/20 rule to automatically classify all of your transactions. Neontra is the better option if you enjoy using that budgeting strategy and are prepared to take a chance on a developing PFM.

Is Monarch Money safe to use?

Monarch is more expensive than most budgeting apps, but for those who want to keep an eye on their whole financial situation, it can be a worthwhile purchase. Some applications don't track investments or reveal your net worth, but Monarch does. It also provides you with standard budgeting and spending features so you can keep an eye on your money now and accumulate wealth over time.

While Monarch is a useful software for singles, it is even more valuable if you're interested in joint budgeting with your significant other or want a tool that you can use with your financial advisor. Because of its collaborative design, you may access all the necessary information to connect accounts and communicate financial goals while maintaining separate logins.

Frequently Asked Questions

1. Is Monarch Money Real?

A: This tab's content is placeholder. While it is still only a placeholder to assist you see how the text is displayed, it is crucial that the block contain the relevant information. Edit this with your own content, if you'd like.

2. Can customers move from Mint to Monarch Money?

A: Users of Mint seeking for a different budgeting application can try Monarch Money instead. Actually, a special offer from Monarch Money is available to former Mint customers alone. Get 50% off your first year of Monarch Money and a complimentary 30-day trial if you were a Mint customer before.

3. Is Monarch Money a good replacement for mint?

A: It fulfills all of my needs and greatly simplifies money management. Compared to Mint, Monarch is superior. Every month or two, I would have to rejoin several of my accounts because Mint would frequently have problems importing data from them. In Monarch, those same accounts remain connected.

4. How much is Monarch Money per month?

A: The cost of the budgeting app Monarch Money is $14.99 per month or $99.99 annually. The annual plan, which costs $8.33 a month, is a better value. Former Mint users are eligible for a 30-day free trial, and Monarch Money offers a free seven-day trial.

5. What are the Benefits of Monarch Money?

A: With the aid of the money management app Monarch Money, you can keep tabs on your accounts, make budgets, and establish objectives. More than 13,000 financial institutions, including credit cards, loans, mortgages, retirement accounts, investment accounts, and checking and savings accounts, can be integrated with it.

6. Do Monarch Money have a free version?

A: If you choose not to upgrade, Monarch Money does not offer a functionally free version of its app that you may always use. To test its features and decide if it's the perfect app for them, all users can begin with a free seven-day trial. Additionally, Monarch Money occasionally offers 30-day free trials, allowing you to test the app longer before upgrading.

7. Do Monarch Money track Cryptocurrency?

A: Yes, you can track your bitcoin assets with Monarch Money by connecting to Coinbase. You can see the current value of your investments after you're linked to your Coinbase account. Every few minutes, Monarch Money updates the information on your Coinbase account, ensuring you always have access to the most recent information.